Summary

Achillion Pharmaceuticals delivered extremely robust outcomes for the Phase 1 study of ACH-5228 and thereby galvanized the shares to trade multiple folds higher.

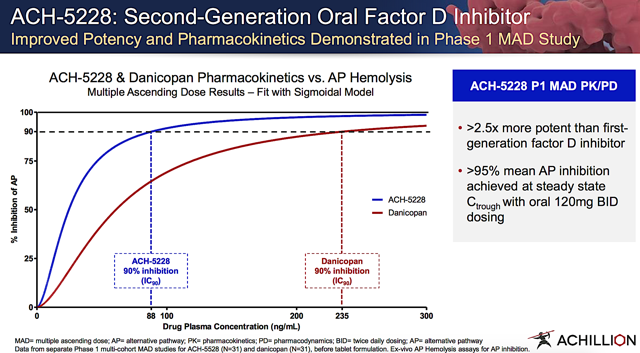

The second-generation Factor D inhibitor (ACH-5228) demonstrated over 95% inhibition of the alternative complement pathway.

With stellar data, Achillion advanced ACH-5228 into a Phase 2 study. An investigational new drug application for ACH-5228 is expected by year-end.

Looking for more? I update all of my investing ideas and strategies to members of Integrated BioSci Investing. Get started today »

You only have to do very few things right in your life so long as you don't do too many things wrong. - Warren Buffett

Though successful innovation entails mega-profits, the field is fraught with risks. Therefore, a bioscience theme that I like is when a company genuinely admits failure and thus abandons a former area of focus. In my view, it's prudent to shift gears when either the drug did not generate promising data or the market is overcrowded. The aforesaid phenomenon epitomizes the saga of unfolding events centering Achillion Pharmaceuticals (ACHN).

After years of tinkering with molecules for the hepatitis market, Achillion shares took a beating. Make no doubt, Achillion can make excellent medicine. It's just that hepatitis isn't a fertile investment field. With the prowess similar to Achilles, Achillion switched aim to shoot for the mega prospects of the complement-mediated disease market. As it rolled in uncanny data, the stock recently enjoyed a gargantuan rally. The elephant in the room is whether there is further upside. In this research, I'll present a fundamental analysis of Achillion and provide my expectation on this intriguing grower.

Figure 1: Achillion chart (Source: StockCharts)

Figure 1: Achillion chart (Source: StockCharts)About The Company

As usual, I'll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Based in Bluebell Pennsylvania, Achillion is focused on the development and commercialization of small molecule complement inhibitors. Poised in the delivery of hopes to patients, Achillion is striving to serve the strong unmet needs in neurology, nephrology, hematology, and ophthalmology.

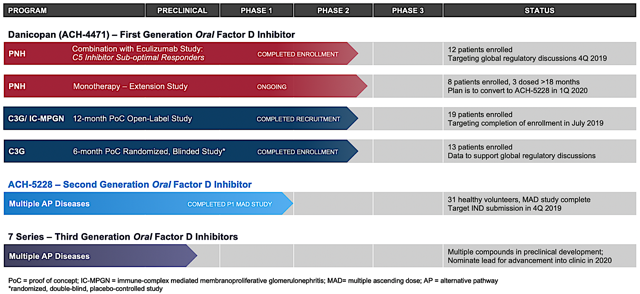

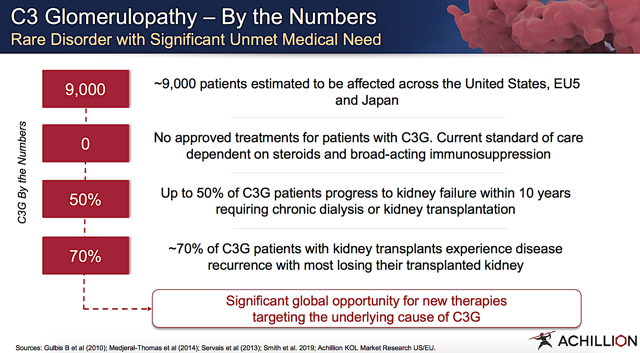

Achillion initially targets markets without an approved medicine. Moreover, the company seeks to capture niches having a robust demand for better treatment options. Accordingly, the ongoing development includes paroxysmal nocturnal hemoglobinuria (PNH), C3 glomerulopathy (C3G), and immune complex membranoproliferative glomerulonephritis (IC-MPGN).

Of note, the first-generation factor D inhibitor ("FDI") dubbed danicopan demonstrated strong preliminary proof-of-concept in patients afflicted by the blood disorder (PNH) and the rare kidney disease (C3G). Riding promising clinical results, Achillion speared danicopan into a Phase 2 investigation for the aforesaid conditions. Asides from danicopan, the firm is brewing two potent and specific orally-administered second-generation FDIs (i.e. ACH-5228 and ACH-5548).

Figure 3: PNH market (Source: Achillion)

Figure 3: PNH market (Source: Achillion)Alternative Complement Pathways

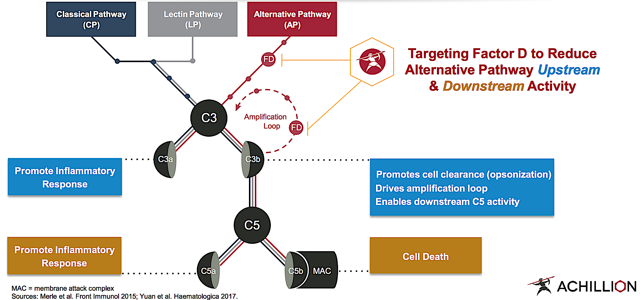

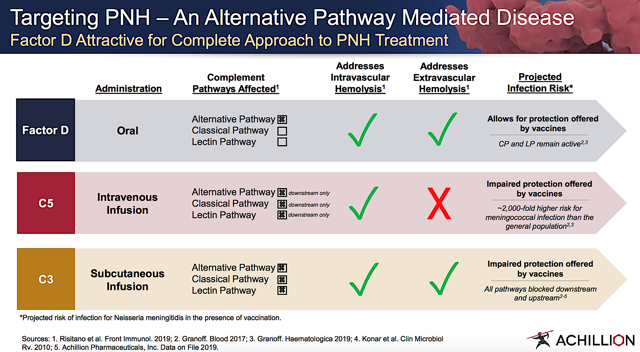

Since Achillion's medicine harnesses the power of the complement system, I'll go over the underlying science powering this beast. The name "complement" is derived from the ability of the complement system to boost the natural defense (i.e. immune) system. Mediated by various small proteins, the complement system comprises of three pathways, including classical, lectin, and alternative.

Though there are over 30 associated proteins, the crucial molecules are Factor D, C3, and C5. As depicted below, the complement system is activated in response to certain trigger proteins. In a series of cleavage reactions, the system executes a cascading effect with one protein activating another. Consequently, this stimulates inflammatory molecules that recruit more phagocytes to clear out the inciting pathogen. As the endpoint in the chain, the membrane attack complex ("MAC") punctures a hole in the bug's cell wall to render it obsolete.

Unfortunately, the complement system can go haywire to induce associated diseases such as PNH, C3G, and IC-MPGN. Being the rate-limiting enzyme of the alternative pathway ("AP"), Factor D has a low plasma concentration. As such, it represents an ideal medicinal target for managing the aforesaid diseases.

Figure 4: Complement pathways (Source: Achillion)

Figure 4: Complement pathways (Source: Achillion)

By inhibiting Factor D, the CP and LP remain intact to combat infection that, in and of itself, is a crucial function of the complement system. Ultimately, the upstream and downstream AP inhibition ameliorates pertinent diseases while preserving immune integrity. Better yet, the small molecule inhibitors that Achillion designed enabled for oral bioavailability and broad systemic as well as tissue distribution.

Figure 5: Advantages of targeting AP (Source: Achillion)

Figure 5: Advantages of targeting AP (Source: Achillion)ACH-5228

Marking a turn of event for Achillion, the firm reported robust results for the Phase 1 study of ACH-5228 outside the U.S. As the data was disclosed on August 08, the financial market showered shareholders with waves of fortunes. In the aforementioned trial, ACH-5228 was administered to patients with dose ranging from 40 mg to 200 mg twice a day for two weeks. Moreover, there is a single-dose cohort that took 240 mg.

Figure 6: ACH-5229 clinical efficacy (Source: Achillion)

Figure 6: ACH-5229 clinical efficacy (Source: Achillion)

Impressively, ACH-5228 demonstrated the near-complete AP inhibition at the 120 mg or higher dosage. In other words, there was over 95% inhibition as measured by AP hemolysis and AP Wieslab assays. Topping the robust efficacy is the fact that ACH-5228 was overall well tolerated. As the stellar results gave Achillion that billion dollars feeling, the company launched ACH-5228 into a Phase 2 study. An investigational new drug ("IND") application with the FDA is expected to occur in 4Q2019. Stoked with strong clinical findings, the President and CEO (Joe Truitt) enthused,

We are pleased the ACH-5228 Phase 1 MAD data exceeded our expectations of our second-generation oral small molecule FDI. With its improved potency and longer durability of effect, we believe that oral ACH-5228 has the potential to be the best-in-class alternative pathway inhibitor. Our plan is to advance ACH-5228 into Phase 2 clinical trials in multiple diseases. Danicopan, our first-generation AP inhibitor, validated factor D as a target and we plan to begin a Phase 3 registrational study in early 2020.

Financial Assessment

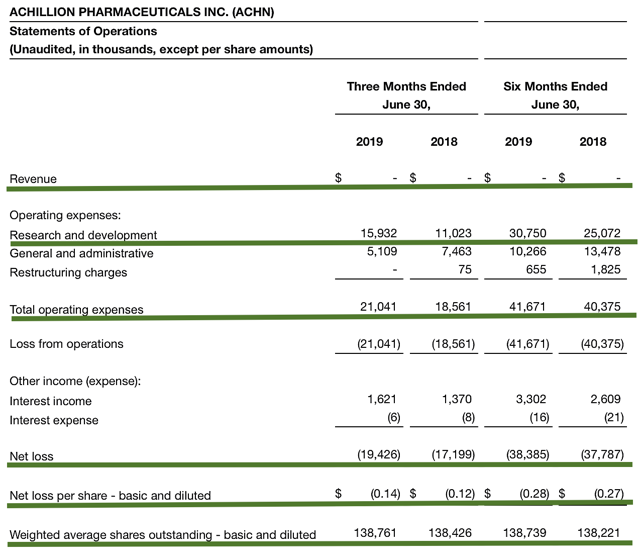

Just as you would get an annual physical for your well-being, it's important to check the financial health of your stock. For instance, your health is affected by "blood flow" as your stock's viability is dependent on the "cash flow." With that in mind, I'll analyze the 2Q2019 earnings report for the period that concluded on June 30. Like other young innovators without an approved medicine, Achillion has yet to generate revenue. That being said, it's fruitful to assess other meaningful metrics.

As follows, the research and development (R&D) expense came in at $15.9M compared to $11.0M for the same period a year prior. The higher spending is related to clinical trial costs for danicopan and ACH-5228. The manufacturing and formulation expenses also contributed. Of note, I view the 44.5% year-over-year (YOY) R&D increase positively because the money invested today can transform into blockbuster profits tomorrow. That aside, there was $19.4M ($0.14 per share) net loss versus $17.2 ($0.12 per share) decline for the same comparison.

Figure 7: Key financial metrics (Source: Achillion)

Figure 7: Key financial metrics (Source: Achillion)

Regarding the balance sheet, there were $241.3M in cash, equivalents, and investments compared to $270.9M for December 2019. Based on the $21.0M quarterly operating expense (OpEx) rate, I calculated that there should be adequate capital to fund operations into 2Q2022 before needing to raise capital. Having an aplenty of cash, the company can still raise capital at an opportunistic time like when the stock is riding high.

I do not mind an offering because a young company needs cash to fund its drugs development. Nonetheless, you need to determine if you are holding a "serial diluter." A firm that employs dilution as a "cash cow" will render your investment essentially worthless. As the shares outstanding increased from 138.4M to 138.7M for Achillion, my rough arithmetics yield the 0.2% dilution. At this rate, Achillion easily cleared my 30% dilution cutoff for a profitable investment. Hence, this company is most definitely not a serial diluter.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are "growth-cycle dependent." At this point in its life cycle, the main concern for Achillion is whether ACH-5228 and danicopan can garner positive clinical results. As I believe both molecules will generate positive outcomes, I ascribed the 35% chances of failure. In such an event, the stock will likely tumble over 50% and vice versa. After all, most value of Achillion resides in those drugs.

For a young company, Achillion might grow too aggressively and thereby runs into potential cash flow constraint. That aside, there is the risk that early trial data might not yield similar advance results.

Conclusion

In all, I recommend Achillion Pharmaceuticals buy with the four out of five stars rating. Powering by excellent medicines for complement-mediated diseases, Achillion set out to conquer this fertile landscape. The early data are extremely robust that I anticipate similar results for advanced trials. Based on Soliris salesof Alnylam Pharmaceuticals (ALNY), I estimated that this market is worth approximately $5B. Remarkably, the current market cap for Achillion is only $643M. Hence, the stock should be worth several folds higher if its drugs can deliver a composite $1B future sales.

As usual, the choice to buy, sell, or hold is ultimately yours to make. In my view, it's prudent to build a small position in Achillion to enjoy further upside. Keep in mind that a stock that recently enjoyed a mega rally like Achillion tends to give back some gains. Therefore, it's strategic to build shares in a "step-wise" fashion. Last but not least, it's important to be realistic and expect profits in the long haul rather than overnight.

Thanks for reading! Please hit the orange "Follow" button on top for updates.

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of subscription.

Very professional, extremely knowledgeable, and very honest… I would highly recommend this service and his stock picks have been very profitable.

Simply put, this is worth every penny. Just earlier today, one of the companies recommended by Dr. Tran got acquired for a nice 50% premium.

As I reserve higher market intelligence and exclusive features for IBI members, I invite you to take my temporary offer of 2 weeks FREE TRIAL.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: As a medical doctor/market expert, Dr. Tran is not a registered investment advisor. Despite that we strive to provide the most accurate information, we neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. We reserve the right to make any investment decision for ourselves and our affiliates pertaining to any security without notification except where it is required by law. We are also NOT responsible for the actions of our affiliates. The thesis that we presented may change anytime due to the changing nature of information itself. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as recommendations to buy or sell any form of security. Our articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your actions. You should also consult with your own financial advisor for specific guidance, as financial circumstances are individualized.